Borrowers

3.1M

Countries

81

Loans funded

$1.26B

Repayment rate

96.8%

Problem

Solution

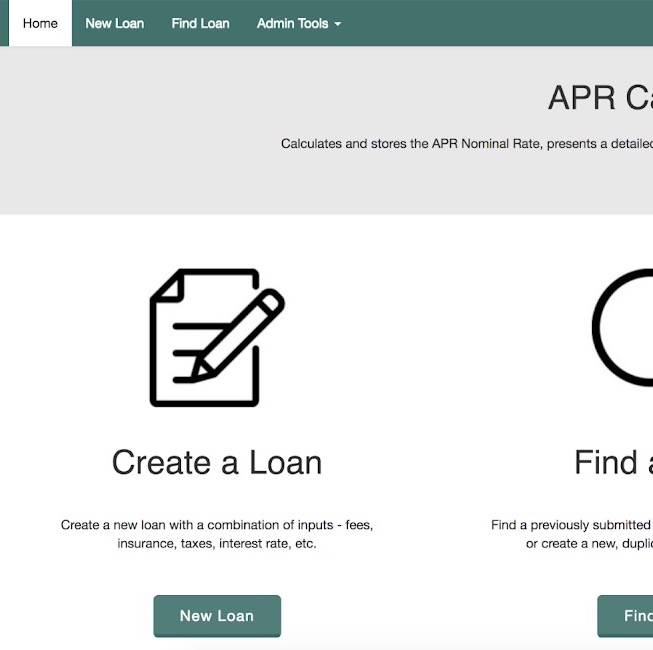

Kiva extends its loan-giving ability through third parties such as microfinance institutions, schools, or social enterprises. Kiva fellows and partnership managers currently use a comprehensive excel tool to assess the financial compliance, health, and fairness of these third party organizations. However, this tool is difficult to use and understand, making it “universally hated” by Kiva employees and volunteers.

We worked with Kiva to create an intuitive web application that consists of three main features: creating a new loan, searching for a loan, and admin tools to manage and cleanly processes the critical inputs and outputs an accurate APR rate, repayment schedule, and loan payment visualization. The interface also allows for saving loans and pulling up previously saved loans to view, duplicate, or edit. The admin tools allows the overarching lists of approved Field Partners and Loan Themes are able to be modified.